Budget Management Foundations

Running a department means making tough calls about money. You've probably been there – staring at spreadsheets at 10 PM, wondering if you're allocating resources the right way.

This program walks you through the practical side of departmental budgeting. We focus on what actually works in Australian organisations, not theoretical models that fall apart when you're under pressure.

Starting August 2026, we're running an intensive six-month program designed for mid-level managers who need to get comfortable with budget planning, forecasting, and reporting.

What You'll Actually Learn

The program runs from August 2026 through January 2027. Each phase builds on the last, so you're not drowning in theory without context.

Budget Fundamentals

We start with the basics because most managers haven't been formally trained in this stuff. You'll get comfortable with financial terminology, understand how departmental budgets fit into organisational planning, and learn to read financial reports without feeling lost.

- Breaking down income statements and balance sheets

- Understanding variance analysis when actuals don't match forecasts

- Building your first department budget from scratch

- Identifying cost centres and expense categories that matter

Forecasting and Planning

This is where things get interesting. Forecasting isn't about guessing – it's about using historical data, understanding seasonal patterns, and making educated predictions. You'll work with real datasets and learn techniques that hold up under scrutiny.

- Creating rolling forecasts that adjust as conditions change

- Scenario planning for best case, worst case, and realistic outcomes

- Using trend analysis to spot patterns in spending

- Communicating budget needs to senior leadership effectively

Advanced Budget Control

The final phase focuses on managing budgets throughout the financial year. Things go wrong – projects overrun, unexpected costs pop up, priorities shift. You'll learn how to adapt without losing control of your numbers.

- Monthly reporting processes that actually inform decisions

- Handling budget cuts and reallocation requests

- Working with procurement and finance teams

- Year-end reconciliation and preparing for the next cycle

Program Investment

We've structured three options depending on how much support you need. All prices include course materials, access to our online platform, and six months of instructor support.

Self-Paced

$2,400 AUD- Complete course materials and video lessons

- Budget templates and planning tools

- Online discussion forum access

- Email support within 48 hours

- Certificate upon completion

Guided Learning

$4,200 AUD- Everything in Self-Paced option

- Bi-weekly live sessions with instructors

- Small group workshops (max 15 participants)

- Personalised feedback on your budget work

- Priority email and phone support

- Networking events with other participants

Executive Track

$6,800 AUD- Everything in Guided Learning option

- One-on-one coaching sessions (8 hours total)

- Custom case studies from your organisation

- Direct phone line to instructors

- Post-program follow-up consultations

- Advanced financial modelling workshops

Payment Options

We understand that budget approvals can take time. We offer flexible payment arrangements that work with organisational procurement cycles.

Next Intake: August 2026

Registration closes 15th July 2026. We cap enrolment at 45 participants to maintain quality interactions and personalised support.

Register Your InterestWho's Teaching This

Our instructors have spent years managing departmental budgets in Australian organisations. They know what works when you're dealing with real constraints and competing priorities.

Kasper Vesterholm

Senior Budget AnalystKasper spent twelve years managing departmental budgets for government agencies in Queensland. He's handled everything from emergency budget reallocations to multi-year infrastructure planning. His approach focuses on clear communication and practical systems that don't require constant babysitting.

Siobhan Rafferty

Financial Planning SpecialistSiobhan transitioned from corporate finance to education after running budgets for three different divisions at a major Sydney retailer. She's particularly good at teaching forecasting techniques and helping managers understand the story their numbers are telling.

Lachlan Drummond

Budget Systems ConsultantBefore joining miraventora, Lachlan worked as a management consultant specialising in financial systems implementation. He's helped dozens of departments transition from reactive budget management to strategic planning approaches.

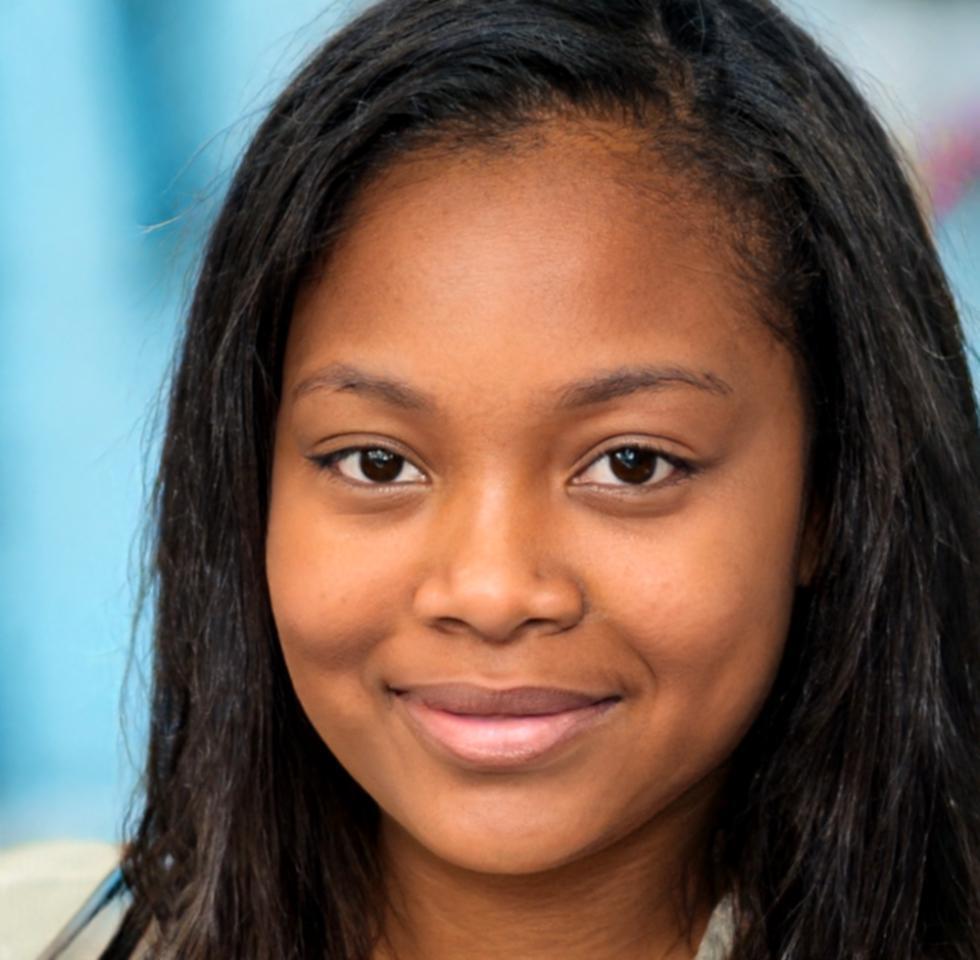

Amara Okafor

Cost Management ExpertAmara brings experience from manufacturing and healthcare sectors where budget precision matters enormously. She teaches the advanced modules on variance analysis and teaches managers how to spot problems before they become crises.